Bangladesh Currency to Float Freely

In a landmark decision, Bangladesh’s central bank has made a historic move by allowing its currency, the taka, to float freely for the first time. This decision, driven by demands from the International Monetary Fund (IMF), aims to unlock additional funds from a $4.7 billion loan program. Bangladesh joins a growing list of nations, including Pakistan, Egypt, and Lebanon, that have opted to loosen control over their local currencies to secure financing from the IMF.

Benefits of a Market-Driven Exchange Rate Regime:

The adoption of a market-driven exchange rate regime is expected to bring several advantages to Bangladesh’s economy. The regime will enhance transparency and efficiency in foreign exchange transactions, benefiting businesses, individuals, and the overall economy. Despite concerns of depreciation, the central bank remains optimistic, anticipating only a modest decline in the value of the taka, which has already experienced a slight 5% decrease this year.

Impact on Financial Markets:

Following the announcement, the taka experienced a decline of up to 0.9% against the dollar. However, the broader index of the Dhaka Stock Exchange witnessed a significant increase of up to 0.3%, marking the largest gain since June 7. This positive movement reflects the potential for a looser currency regime to bolster Bangladesh’s reserves by making its exports more attractive.

Transition and Future Outlook:

Since gaining independence in 1971, Bangladesh has relied on fixed exchange rates to manage volatility and ensure affordable imports. With the adoption of a unified exchange rate regime between the taka and the dollar (or any other foreign currency), the country aims to bridge the gap between formal and informal markets. Starting from July 1, the central bank will cease selling foreign exchange at a discounted rate, and by the third quarter of 2023, all international transactions will be based on the new exchange rate structure.

Financial Considerations:

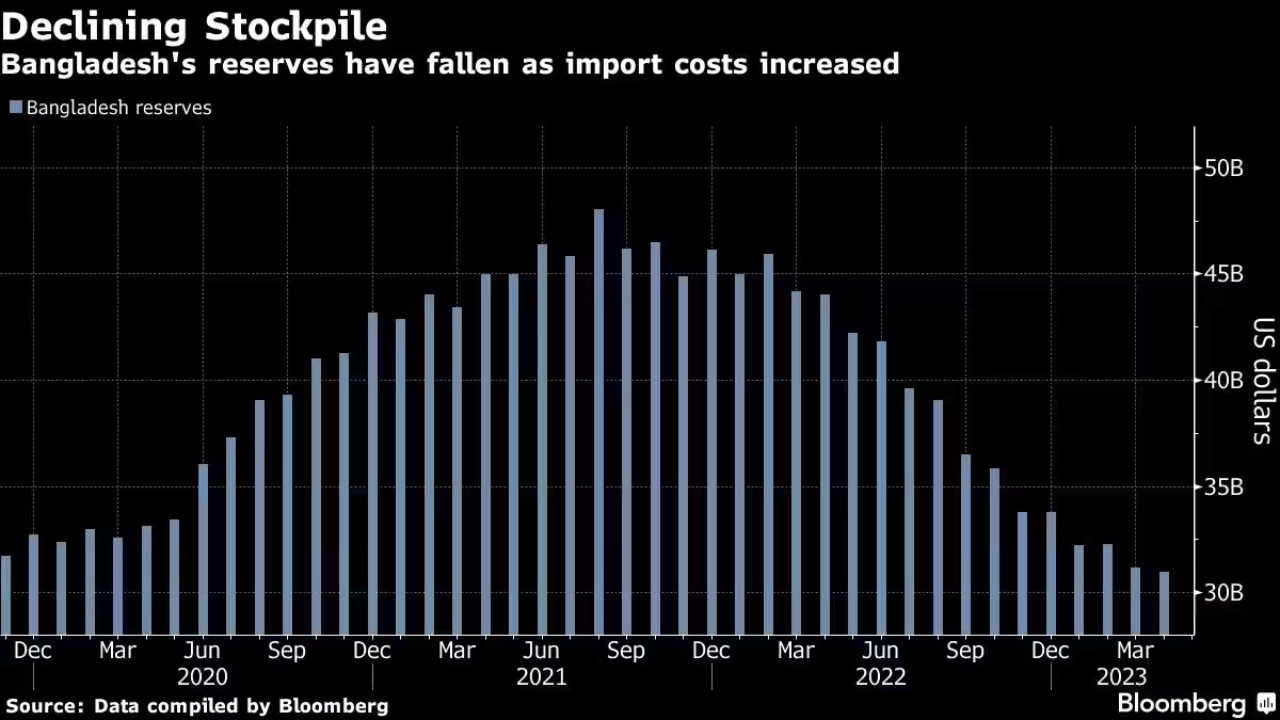

Bangladesh’s central bank has already sold approximately $13 billion in the current fiscal year due to increased demand for foreign currency. The government received the first installment of $476 million from the IMF loans in February, with the second tranche expected in November. Prime Minister Sheikh Hasina has expressed confidence in her country’s ability to repay the loan, emphasizing that the IMF provides assistance to nations capable of meeting their financial obligations.

Moody’s Downgrade and Inflation Concerns:

Moody’s Investors Service recently downgraded Bangladesh’s ratings to B1 from Ba3, citing weakened economic conditions and heightened external vulnerability and liquidity risks. The central bank downplayed the impact, noting that the downgrade would not directly affect sovereign bonds as Bangladesh has not issued any. To address concerns about inflation, the country aims to achieve a growth target of 7.5% in the upcoming fiscal year, starting July 1, and plans to implement a tight monetary policy for the first half of the new fiscal year, adjusting interest rates accordingly.

Key Points About Different Kinds of Exchange Rate Regimes:

- Free and Floating Currency:

- Definition: A currency with an exchange rate determined by market forces without interference from the central bank or government.

- Market Forces: Fluctuates based on economic indicators, interest rates, inflation, trade balances, and investor sentiment.

- Flexibility: Allows for rapid adjustment of the exchange rate, providing flexibility in international trade and investment.

- Transparency: Enhances transparency and efficiency in foreign exchange transactions, benefiting the overall economy.

- Managed Currency:

- Definition: A currency influenced by the central bank or government within certain boundaries, but still exhibiting some degree of flexibility.

- Central Bank Intervention: Actively intervenes in the foreign exchange market to influence the exchange rate.

- Exchange Rate Band: Sets a target range within which the exchange rate can fluctuate, intervening when approaching the boundaries.

- Policy Objectives: Manages the currency to achieve specific policy objectives such as export competitiveness, price stability, or managing external debt.

- Controlled Currency:

- Definition: A currency with a fixed or pegged value to another currency, often a major reserve currency.

- Exchange Rate Stability: Maintains a fixed exchange rate through active buying or selling of the currency.

- Import Stability: Stabilizes import prices, allowing businesses to plan transactions based on a predictable exchange rate.

- Reduced Currency Volatility: Aims to reduce exchange rate volatility and provide a stable environment for trade and investment by pegging the currency to a more stable foreign currency.

Conclusion:

Bangladesh’s decision to adopt a free-floating currency regime marks a significant step towards economic liberalization and financial stability. The move aligns the country with a growing trend among nations seeking IMF financing. While challenges such as the recent Moody’s downgrade and inflation concerns persist, Bangladesh remains committed to achieving its growth targets and managing its economic affairs effectively through a market-driven exchange rate regime.

- 3 August Current Affairs 2023 in English

- MoU Between Subroto Mukerjee Sports and Education Society and All India Football Federation (AIFF) to Promote Football at Grassroot Level

- Dr. Mansukh Mandaviya Delivers Keynote Address at the 13th Indian Organ Donation Day ceremony

- Education Ministry Forms Expert Panel on Anti-Discrimination in Higher Education

- Concerns Arise Over Cheetah Deaths at Kuno National Park